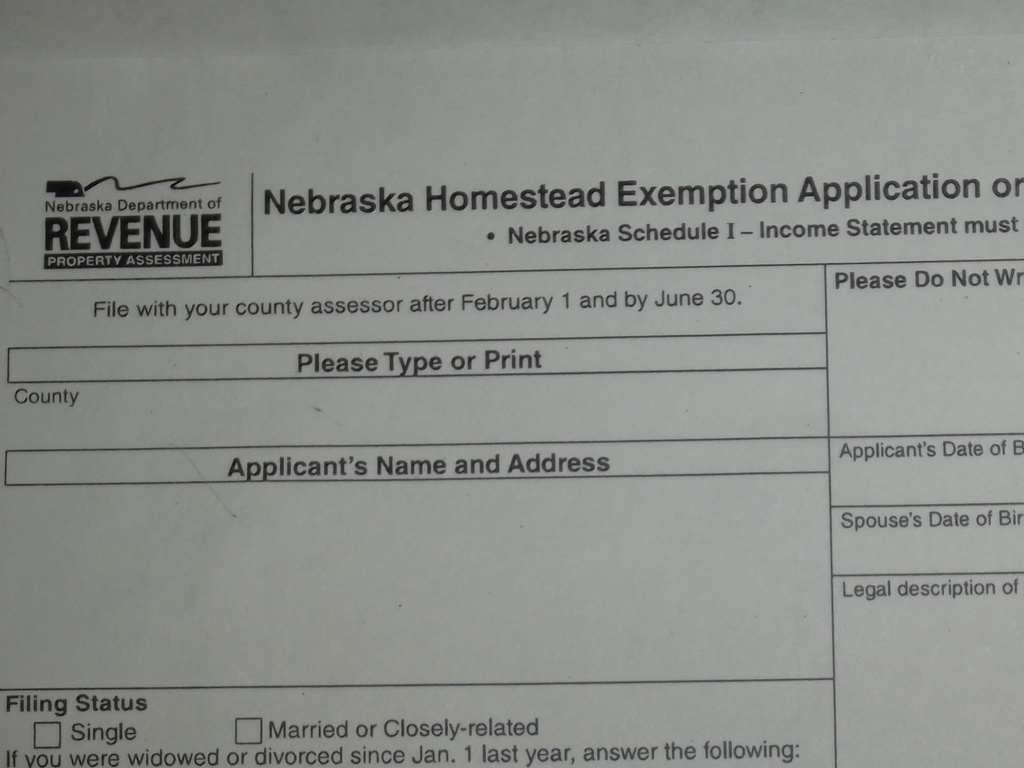

(KLZA)-- The Nebraska Department of Revenue, Property Assessment Division reminds property owners that then Nebraska Homestead Exemption Application Form #458, must be filed with their county assessor before June 30, 2020.

The homestead exemption provides relief from property taxes by exempting all or a portion of the taxable value of the residence. The State of Nebraska reimburses counties and other governmental subdivisions for the property taxes lost due to homestead exemptions.

In Nebraska, a homestead exemption is available to: persons over the age of 65; Qualified disabled individuals; or Qualified disabled veterans and their widow or widowers.

Some categories are subject to household income limitations and residence valuation requirements.

More information on the homestead exemption program is available from your county assessors office or the Nebraska Department of Revenue, Property Assessment Division.

© Many Signals Communications

MOST VIEWED STORIES

Atchison woman pleads to charges in fatal crash

3 arrested in Hiawatha drug bust

Public health advisory issued for two local lakes

Updated: Officer shooter search leads to arrest

Baniewicz on leave at Bishop Miege; investigation launched

Former Kickapoo Tribal Chair pleads to child porn-related charge

Atchison man earns prison from injurious outburst

Falls City man sentenced to prison on multiple charges

State Audit discovers alleged financial misconduct

Death of puppy leads to Atchison arrest

Falls City Council member rescinds resignation

Young sex offenders earn sentences in Atchison Co

Atchison's Lust found safe following disappearance

Candidate list finalized in Brown Co

Woman injured after striking object on Nemaha Co highway

Arrest following search warrant in Mayetta

3 local communities awarded small-town grants

Atchison Co cemetery thefts being investigated

LATEST STORIES

Hiawatha man sentenced to prison

Atchison among local areas surveyed for street safety

Atchison's Patriot Street bridge set for replacement

Senator Moran visits two local hospitals

Biking Across Kansas to make two local stops

Seneca City Council approves purchase of robot

Public health advisory issued for two local lakes

Baniewicz on leave at Bishop Miege; investigation launched

Printer Friendly

Printer Friendly

Email to a Friend

Email to a Friend