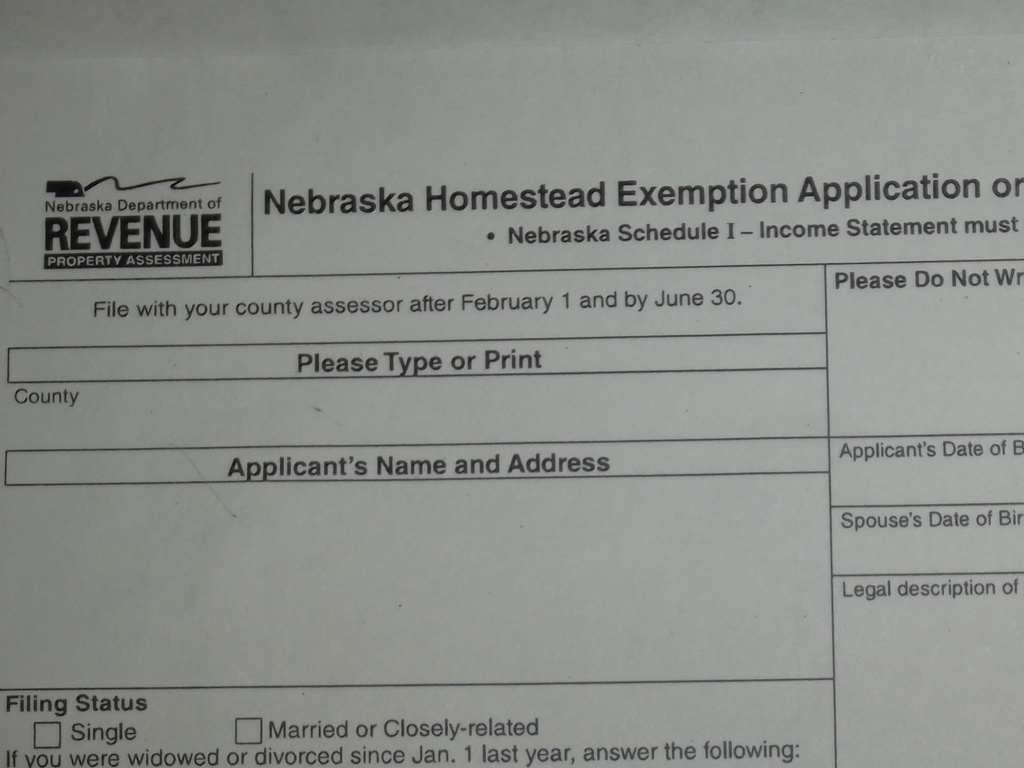

(KLZA)-- The Nebraska Department or Revenue, Property Assessment Division reminds property owners that Nebraska Homestead Exemption Application or Certification Form 458 must be filed with their county assessor on or before June 30th.

Homestead exemptions provide relief from property taxes for persons over the age of 65; qualified disabled individuals; and qualified disabled veterans and their widows.

The Homestead exemption can exempt all or a portion of the taxable value of the residence. The State of Nebraska reimburses counties and other governmental subdivisions for the property taxes lost due to homestead exemptions.

For more information on the homestead exemption program, contact your county assessors office, or the Nebraska Department of Revenue, toll free 1-888-475-5101.

© Many Signals Communications

MOST VIEWED STORIES

Walnut Township recall coming; Friday mtg erupts in arrest

Former Kickapoo Tribal chairman arrested

Severe storms move through NE KS

Sabetha woman arrested in business burglary

Winchester native named as Amberwell CEO

Effingham teen facing child sex crimes charges

Holton property search concludes with arrest

Rural Horton man charged in alleged beating

Severe storms reported Tuesday in NE KS

Meriden man bound over on rape charge

KS prepares for severe weekend weather

Former AG Schmidt running for KS' 2nd Congressional District

Richardson County Deputies busy during special enforcement

Commission approves agreement for budget help

Council hears report from golf course

Pawnee City School Board approves personnel changes

Beef Barn replacement planned in Jefferson Co

NVCH receives $415,000 grant for expansion project

LATEST STORIES

Road, railway repairs, underway in Atchison this week

KS replacement plates see long wait times

Atchison man nabbed for neighbor's 4 wheeler theft

One injured in Holt County MO wreck

Field survey set in Brown Co at U.S 77/K-20 junction

Severe storms reported Tuesday in NE KS

Effingham teen facing child sex crimes charges

Pawnee County Rural Health Clinic participating in DHHS program

Local students participation in Peru State research expo

Meetings to help with Homestead Exemptions scheduled in Johnson County

Printer Friendly

Printer Friendly

Email to a Friend

Email to a Friend